Alternative investments for diversified portfolios

Rally Trading Strategy

Rally was developed over a 7-year period by professional traders. Its algorithm enters long / short trades in currency pairs, indices, and commodities, with pre-determined profit and stop loss levels before identified inflection points based on breakout levels.

The algorithm uses a number of indicators:

- Moving Averages, RSI, Stochastic Oscillator;

- Colours, Harmonic Patterns (Gartley);

- Grid Levels, Fibonacci Extension Levels;

- Distance Between SMAs, Average True Range;

- Bollinger Band Type 1 & Type 2, Pivot Points, AB=CD ;

- Proprietary Power Grid Breakout Indicator;

Rally continuously scans over 250 financial instruments for trigger points to initiate a trade. The entry point provides the optimal timing and pricing. Once Rally initiates a trade, it immediately places additional trades at different levels, with different sized lots, dynamic stop-loss and take-profit levels, and risk adjustments based on “current” position exposure.

CTS's trading account at Praxis Digital Trading Group LLC (Cayman Islands Monetary Authority registered 1602753) receives trading signals from Rally.

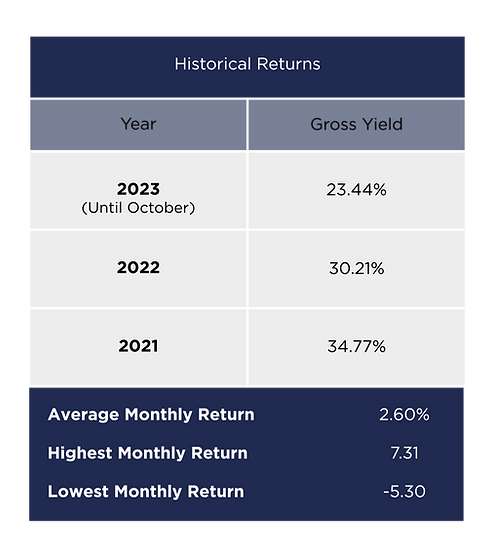

Rally Trading Strategy

Monthly Results

Top 10 Most Tradded Assets Percentage Of Total Trades

Alternative investments diversify and decrease overall portfolio risk by adding strategies outside of major asset classes and achieving returns in any market conditions.

CTS shares are a unique product, offering returns with exposure to the lucrative currency market not otherwise easily available.

Institutional clients seeking an opportunity to access inflation protection and hedge currency exposure.

Retail investors are provided an alternative investment with currency exposure.

-

Focus on governance provides a strong management and oversight framework.

-

Internal control is exercised through compliance and risk management procedures monitored by a designated compliance officer.

-

Investment strategies are selected on the basis of a rigorous process to ensure proven investment strategies and algorithms.

-

Public company structures and procedures to enhance transparency and accountability.

-

Brokers and trading accounts are regulated by recognized securities authorities with a strong track record of regulatory oversight.

FX Liquidity Trading Strategy

Risk Management

Portfolio Suitability

Contact Us

Outreach & Communications: “always-on” investor outreach & support, including open office approach for retail and institutional investors.

Continuous Disclosure: robust company investor page is being created with disclosures and insider reports.

Investor Relations: marketing events and roadshows where company management is available for engagement.

Ishai Strauss

Leads Engineering and Platform Development. Previously founded and led development of the popular decentralized exchange Stellarport.io, which was acquired in 2019. Ishai is an expert in many technologies related to rapid development and deployment of products, especially in the financial sector. Prior to founding Stellarport, Ishai worked as an engineer at various technology companies. Ishai earned a B.Sc. in Chemical Engineering with a minor in Mathematics from the University of Illinois.

Josh Dimarsky

Previously lead AI engineer at Amazon and Audible, where he pioneered a new approach to data processing. Prior to Amazon, Josh was the first employee at Crawford Lake, where he designed and built a reporting and analytics system that was key to the fund’s rapid growth from 80 million to 1.1 billion in AUM, and was responsible for back office, operations, IT, and eventually software and data engineering.

Key Personals

Our Story

Consolidated Trading Strategies (CTS)develops, licenses and invests in proven algorithmic trading strategies bringing an alternative financial

product to investors.

Future trading strategies will be identified and assessed by an established investment committee according to stringent criteria balancing risks and rewards.

CTS' inaugural trading strategy (Rally) uses inflection points to trade in foreign exchange, contracts for differences, indexes, and commodities. A second strategy in FX spot trading is expected to be implemented in early 2024.

CTS anticipates raising additional investment funds through a preference share offering and expects to pursue a public listing on a Canadian stock exchange in 2024.

The company key personals have a proven track record in applying cutting edge technology to investment management.

We apply machine learning to signal research, proprietary execution, and portfolio management algorithms.

By marrying our big data capabilities with cutting edge mathematical and statistical applications we have built a predictive machine learning platform to optimize our technological and strategic insights. This has provided us with a distinctive edge with respect to the competition in creating a profitable and stable trading platform.

Having properly established ourselves in the industry we have been able to form high level partnerships with tier one brokers and exchanges. We use these partnerships to further boost our risk adjusted returns by taking advantage of our partners’ proprietary liquidity pools. Specifically, we are able to help our partners offload risk by using our adapted models to accurately price and hedge this risk across the currency markets. The efficiency of our execution allows us to remain nearly completely hedged while generating profits via rebates and advantageous cost structures, i.e. compensation from our partners for the service of removing risk from their liquidity pools.

Oscar Eskin

Leads Strategy and Research. Previously Head of Quantitative Research and Risk Management at Crawford Lake, a long-short equity hedge fund with 1 billion in AUM. From 2016 to 2018, Oscar was at BlackRock developing models for portfolio construction, asset allocation, and risk management as a Quantitative Researcher in the Multi-Asset Strategies Group. Before BlackRock, Oscar was a researcher at the University of Chicago in economics and applied mathematics. Oscar completed his academic studies at the University of Helsinki, earning a M. Phil. in Mathematics (eximia cum laude), and a B.Sc. with a double major in Mathematics and Economics.